When it comes to evaluating investment performance, the most commonly cited number is often the nominal return—the percentage gain an investor sees on paper. However, nominal returns tell only part of the story. If you’re not accounting for inflation, you may be overestimating how much your wealth has actually grown. This is where real return comes in—a measure that adjusts for inflation and offers a clearer picture of an investment’s impact on your actual purchasing power.

In this article, we’ll explore the key differences between nominal and real returns, examine how inflation affects investment performance, introduce the Fisher equation, and show you how to calculate and interpret both measures accurately.

Contents

Nominal return vs real return: Key differences

Nominal rate of return is the percentage increase in the value of an investment over a period of time without adjusting for inflation. It includes capital gains, dividends, and interest but doesn’t account for changes in purchasing power. For example, if you invest $1,000 and it grows to $1,100 after one year, your nominal return is 10%, regardless of whether inflation was 0% or 9% during that year.

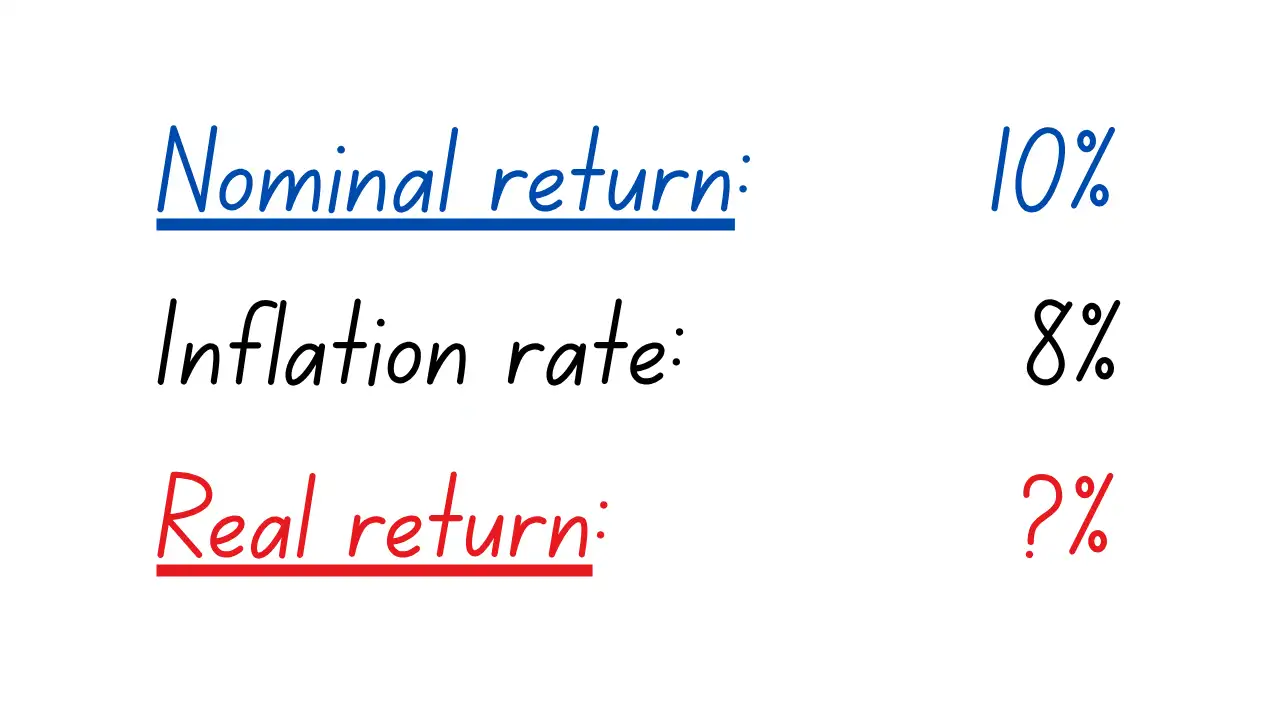

Nominal returns are what most brokerage statements and performance summaries report. They are easy to calculate and understand, but they can also be misleading when inflation is significant. A 10% return might seem satisfying at first glance, but if the cost of goods and services rose by 9% during the same period, your real gain is minimal.

A real rate of return, on the other hand, adjusts for the effects of inflation to provide a more accurate assessment of how much an investment has increased your purchasing power. It answers the question: “How much more can I actually buy as a result of this investment?” If your investment grew by 10% over the past year, but inflation was 9%, your real return is closer to 1%. This distinction becomes particularly important during inflationary periods, when the prices of goods and services rise rapidly and erode the value of nominal gains.

The real return allows you to compare investments across time and economic environments. For instance, earning a 5% nominal return in a year of 0% inflation is very different from earning the same nominal return in a year of 6% inflation. In the former case, you’re gaining real wealth. In the latter, your purchasing power is actually decreasing.

| Feature | Nominal rate of return | Real rate of return |

|---|---|---|

| Adjusted for inflation (i.e., reflects purchasing power) | ❌ No | ✅ Yes |

| Useful for | Quoting gains on paper | Evaluating actual wealth increase |

| Common in | Account statements, market quotes | Financial planning, retirement modeling |

Nominal return formula: Understanding the Fisher equation

The relation between the nominal rate of return Rn, real rate of return Rr, and the inflation rate I is governed by the nominal return formula, which is also known as the Fisher equation (named after the American economist Irving Fisher):

Example 1

Let’s say your investments yielded a nominal return of 12% last year. During the same year, the inflation rate was 5%. What was your real return over this period?

1 + 12% = (1 + Rr) (1 + 5%)

1.12 = (1 + Rr) (1.05)

Rr = 1.12 / 1.05 − 1 = 6.67%

Note that so long as the inflation rate is positive, the real rate of return is always smaller than the nominal rate of return. Moreover, when the nominal rate of return and the rate of inflation are both low, the real return is approximately the difference between the nominal return and the inflation rate as follows:

Rr ≈ Rn − I

Example 1 (continued)

Given the same inputs, compute Rr approximately as the difference between Rn and I.

1 + 12% = (1 + Rr) (1 + 5%)

1.12 = (1 + Rr) (1.05)

Rr ≈ 12% − 5% = 7%

This is not too far from the exact figure of 6.67% computed above. In general, the lower Rn and I, the better the approximation works.

Understanding the difference between nominal and real returns is vital for long-term investors, especially those saving for retirement or other long-term goals. A nominal return that appears sufficient on paper might fall short when adjusted for inflation, particularly in times of rising prices. If your investments do not at least match inflation, you are effectively losing money in terms of what you can buy.

In the context of retirement planning, underestimating the effects of inflation can result in a portfolio that fails to meet your future needs. This is why financial planners often focus on real returns when projecting the growth of retirement accounts, college funds, or other long-term investment vehicles.

Real return calculator

The calculator below allows you to compute the real return based on the Fisher equation discussed above.

Video summary

What is next?

Recommended posts for you

This lesson is part of our free course on investments.

- Next lesson: We will explain how to calculate holding period returns when assets are held over multiple periods.

- Previous lesson: We showed how to compute the total return of a stock based on its capital gains and dividend yield.

Further reading:

Crowder, W. J. and Hoffman, D. L. (1996) ‘The Long-Run Relationship between Nominal Interest Rates and Inflation: The Fisher Equation Revisited‘, Journal of Money, Credit and Banking, Vol. 28 (1), pp. 102-118.

Please share this post with your friends and connections if you enjoyed reading it. Also, please contact us if you noticed any errors or have any suggestions/questions.